The 8 Things People Want Most from an AI Personal Finance Platform

Smooth bank integrations and rock-solid security are just two things people want most from an AI personal finance platform. Read on to learn the other six, and find out how Flatiron’s Hackonomics hackathon teams will incorporate all eight into their Money Magnet final projects.

Great product design is one of those things you just know when you see it, and more importantly—use it. It’s not just about being eye-catching; it’s about serving a real purpose and solving a real problem—bonus points if you can solve that problem in a clever way. If there ever was a time to build a fintech app, that time is now. The market is ripe, the problems to solve are plenty, and the tools and resources are readily available. Flatiron School Alumni from our Cybersecurity, Data Science, Product Design, and Software Engineering bootcamps have been tasked to help me craft Money Magnet, an AI personal finance platform that solves common budget-making challenges. They’ll tackle this work during Hackonomics, our two-week-long hackathon that runs from March 8 to March 25.

There is one goal in mind: to help individuals and families improve their financial well-being through an AI financial tool.

My Personal Spreadsheet Struggle

The concept for Money Magnet sprang from personal frustration and mock research around user preferences in AI finance. As a designer, I often joke, “I went to design school to avoid math.” Yet, ironically, I’m actually quite adept with numbers. Give me a spreadsheet and 30 minutes, and I’ll show you some of the coolest formulas, conditional formats, and data visualization charts you’ve ever seen.

Despite this, in my household, the responsibility of budget management falls squarely to my partner. I prefer to stay blissfully unaware of our financial details—knowing too much about our funds admittedly tends to lead to impulsive spending on my part. However, occasionally I need to access the budget, whether it’s to update it for an unexpected expense or to analyze historical data for better spending decisions.

We’re big on goal-setting in our family—once we set a goal, we stick to it. We have several future purchases we’re planning for, like a house down payment, a new car, a vacation, and maybe even planning for children.

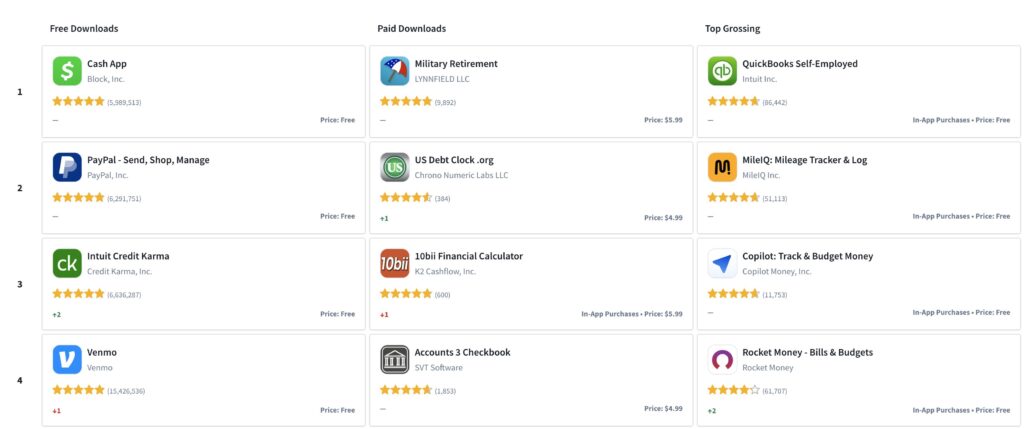

But here’s the catch: None of the top AI financial tools on the market incorporate the personal finance AI features that Money Magnet proposes bringing to the market. Families need an AI personal finance platform that looks into our spending patterns from the past and projects into the future to tell users when the budget gets tighter. This product should be easy to use with access to all family members to make changes without fear of wrecking the budget.

For more context, each year, my partner forecasts a detailed budget for us. We know some expenses fluctuate—a grocery trip might cost $100 one time and $150 the next. We use averages from the past year to estimate and project those variable expenses. This way, we manage to live comfortably without having to scale back in tighter months, fitting in bigger purchases when possible, and working towards an annual savings goal.

But here’s where the challenge lies: My partner, as incredible as he is, is not a visualist. He can navigate a sea of spreadsheet cells effortlessly, which is something I struggle with (especially when it comes to budgeting). I need a big picture, ideally represented in a neat, visual chart or graph that clearly illustrates our financial forecast.

Then there’s the issue of access and updates. Trying to maneuver a spreadsheet on your phone in the middle of a grocery store is far from convenient. And if you make an unplanned purchase, updating the sheet without disrupting the formulas can be a real hassle, especially on a phone. This frustration made me think, “There has to be a better solution!”

Imagining the Ultimate AI Personal Finance Platform

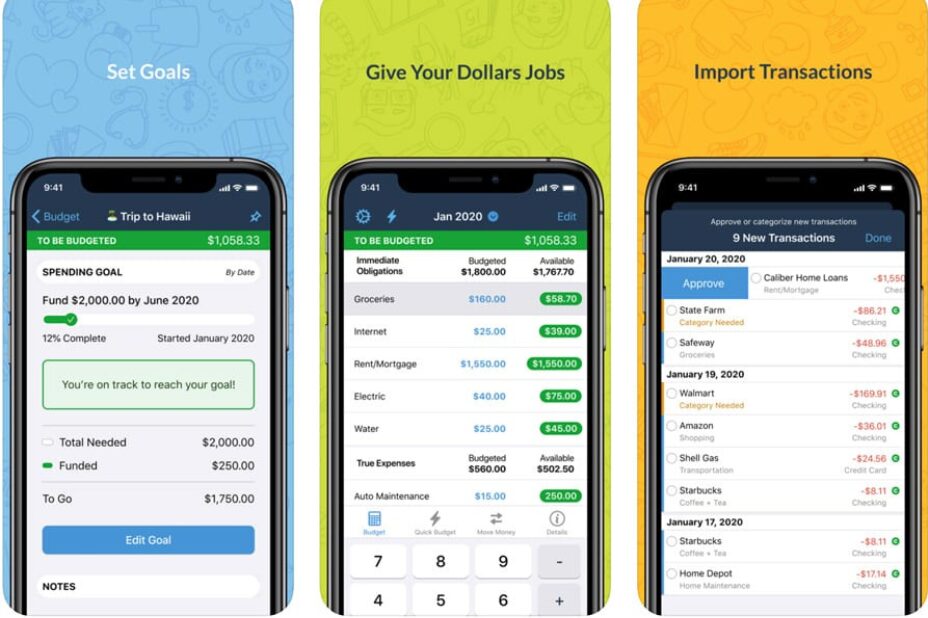

Imagine an AI personal finance platform that “automagically” forecasts the future, securely connects to your bank and credit cards to pull transaction histories, and creates a budget considering dynamic and bucketed savings goals. This dream app would translate data into a clear dashboard, visually reporting on aspects like spending categories, monthly trends in macro and micro levels, amounts paid to interest, debt consolidation plans, and more.

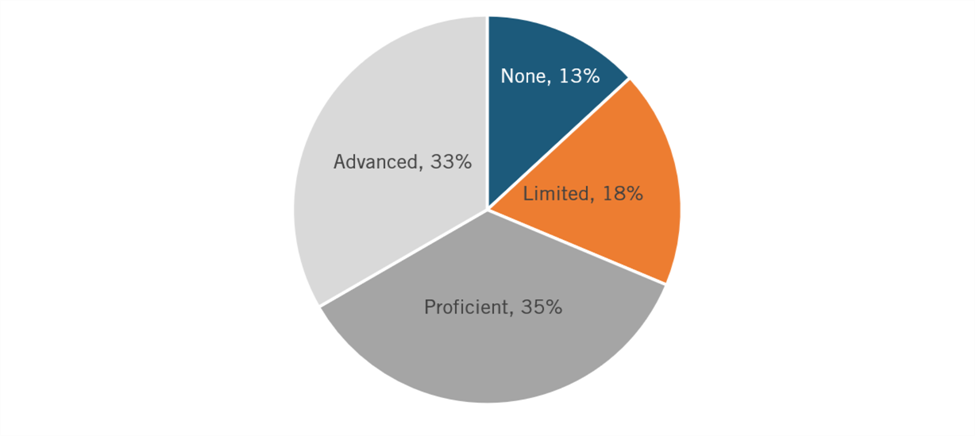

It’s taken eight years of experiencing my partner’s budget management to truly understand a common struggle that many other families in the U.S. face: Advanced spreadsheet functions, essential in accounting and budgeting, are alien to roughly 73% of U.S. workers.

Money Magnet aims to automate 90% of the budgeting process by leveraging AI recommendations about users’ personal finances to solve eight of the key findings outlined in a mock research study based on some of the challenges I had faced when developing a budget of my own.

Features to Simplify Your Finances

This dream budgeting tool is inspired by my own financial journey and the collective wish list of what an ideal personal finance assistant should be. Here’s a snapshot of the personal finance AI features that aims to position Money Magnet as one of the top AI financial tools on the market:

- Effortless Onboarding: Starting a financial journey shouldn’t be daunting. Money Magnet envisions a platform where setting up accounts and syncing banking information is as quick and effortless as logging into the app, connecting your bank accounts, and establishing some savings goals (if applicable).

- Unified Account Dashboard: Juggling multiple banking apps and credit card sites can be a circus act, trying to merge those separate ecosystems as a consumer is nearly impossible. Money Magnet proposes a unified dashboard, a one-stop financial overview that could declutter your digital financial life.

- Personalized AI Insights: Imagine a platform that knows your spending habits better than you do, offering bespoke guidance to fine-tune your budget. Money Magnet aims to be that savvy financial companion, using AI to tailor its advice just for you.

- Vivid Data Visualization: For those of us who see a blur of numbers on statements and spreadsheets, Money Magnet could paint a clearer picture with vibrant graphs and charts—turning the abstract into an understandable, perceivable, engaging, and dynamic visual that encourages you to monitor the trends.

- Impenetrable Security: When dealing with informational and financial details, security is non-negotiable. Money Magnet will prioritize protecting your financial data with robust encryption and authentication protocols, so your finances are as secure as Fort Knox.

- Intelligent Budget Optimization and Forecasting: No more cookie-cutter budget plans that force your spending to fit conventional categorization molds! Money Magnet will learn user preferences in AI finance and forecast from your historic spending, suggesting ways to cut back on lattes or add to your savings—all personalized to improve your financial well-being based on your real-world spending and forecast into the future to avoid pinch-points.

- Smooth Bank Integrations: Another goal of Money Magnet is to eliminate the all-too-common bank connection hiccups where smaller banks and credit unions don’t get as much connectivity as the larger banks, ensuring a seamless link between your financial institutions and the app.

- Family Financial Management: Lastly, Money Magnet should be a tool where managing family finances is a breeze. Money Magnet could allow for individual family profiles, making it easier to teach kids about money and collaborate on budgeting without stepping on each other’s digital toes or overwriting a budget. It’s important for those using Money Magnet to know it can’t be messed up, and that any action can always be reverted.

See the Money Magnet Final Projects During Our Closing Ceremony on March 28

Attend the Hackonomics 2024 Showcase and Awards Ceremony on March 28 and see how our participating hackathon teams turned these eight pillars of financial management into a reality through their Money Magnet projects. The event is online, free of charge, and open to the public. Hope to see you there!

Disclaimer: The information in this blog is current as of March 20, 2024. Current policies, offerings, procedures, and programs may differ.