Flatiron School no longer offers this income share agreement.

Education, we’ve been told, is the key to a better career and future. A college degree is more than a piece of paper. It’s a requirement for many jobs and leads to a better salary. But, the cost of college has increased significantly since 1985 and wages have failed to keep up.

College is expensive and student loan debt for all borrowers is approximately $1.5 trillion, based on federal financial aid and private loan data. For many students, the cost of college is a major hurdle. This is especially true for underrepresented students. Relative to family income, low-income students pay the highest price for college compared to middle-income or higher-income students.

Even with those obstacles, many students choose to go to college with the idea that it’ll help lead to a better life. Unfortunately, many grads feel like they’re not in the middle class. If you have a bachelor’s degree and want to switch careers, going back to college is not a viable option. It’s even harder if you have family or child care responsibilities. There aren’t a lot of options for grads who want a quality education without significant upfront cost.

To help remove the financial barrier to a quality education, some institutions have introduced an income share agreement (ISA) as an alternative to traditional loans. ISAs are a form of deferred tuition that lets students focus on their education instead of tuition. With the Flatiron School On Campus ISA, following an initial deposit, you don’t pay tuition until you’ve left the program and have a job where you’re earning at least a minimum income.

Different programs, coding bootcamps, and universities have their own eligibility requirements and payment options. Let’s take a look at the Flatiron School On Campus ISA to give you a better sense of how this flexible payment plan option works.

In a nutshell, the Flatiron School On Campus ISA works as follows:

Step 1: Pay a refundable deposit before class

Step 2: Learn the Software Engineering, Data Science, or Design skills you need and graduate

Step 3: Get the job you want (after working 1:1 with a dedicated Career Coach)

Step 4: Pay for your tuition (after you’re making at least the minimum income threshold)

The Flatiron School On Campus ISA is currently available in select states. If you meet the eligibility requirements and are in an approved state, you can enroll in one of our immersive Software Engineering, Data Science, or UX/UI Design programs.

You’ll have to pay a refundable deposit (see Refund Terms and Conditions here) before class starts. But the rest of your time at Flatiron School is spent learning the hard skills you need to succeed today and the soft skills like time management and client communication that will help you grow throughout your career.

After you leave the program, and are earning a minimum income, you’ll make monthly payments to pay for your tuition. There’s a cap to how much you’ll pay and how many payments you have to make. You can learn more about the Flatiron School On Campus ISA here.

Additionally, all of our immersive programs include a Tuition-back Guarantee. If you don’t get a job within six months of graduation and you follow all of the terms of our Tuition-back Guarantee (see those terms here), you’re eligible to get your tuition back.

Through the Flatiron School ISA, we want you to succeed and you only pay tuition if you’re earning a minimum salary. Taking this approach eases the financial barrier to a quality education to create a more inclusive and diverse tech community—our mission at Flatiron School.

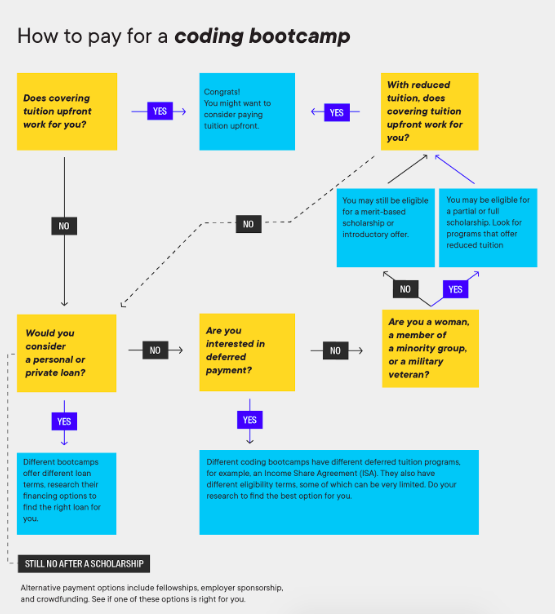

You can learn more about how to pay for a coding bootcamp here.